Eligible businesses can now apply for the latest round of business grants but Crawley Borough Council says the funding is not nearly enough.

Despite Crawley being responsible for 25 per cent of the economic output in West Sussex, it has been given some of the lowest grant funding in the county.

We are looking for sponsors of our news stories. Please email Dan@spottedmediaservices.co.uk

The government has given the council £3,733,396 made up of:

- £1,485,216 in Local Restrictions Support Grant to distribute to businesses that pay business rates and have had to close during the second lockdown

- £2,248,180 in Additional Restrictions Grant, which is given to businesses that don’t pay business rates and have been affected by the lockdown but not legally required to close.

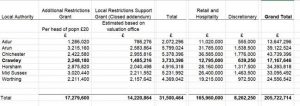

Out of seven local authorities in West Sussex, only one received less than Crawley’s combined grants figure. Five councils received more.

The Additional Restrictions Grant is based on £20 per person in Crawley rather than the number of businesses in the town. This means that Arun District Council, for example, has received £3,215,160 due to a larger population but smaller economy.

And only one council in West Sussex received less than Crawley across both rounds of grant funding in April and November. Crawley received a total of £17,167,646. The highest – Chichester District Council – received £43,739,396.

In the first round of grants earlier this year only 23 per cent of Crawley businesses received financial help from the government.

Councillor Peter Lamb, Leader of the Council, said: “The pot of grant funding provided by the government is very limited and does not recognise the number of businesses we have in Crawley.

“The way the grant settlement is calculated – on population and not on the size of the economy – means we have to turn most businesses away, while other councils have millions to spare. This is causing major hardship at a time when Crawley is already the hardest-hit economy in the UK.”

Businesses that have had to close during the second lockdown can apply for a Local Restrictions Support Grant by visiting https://grantapproval.co.uk

For more information visit

crawley.gov.uk/emergency/coronavirus-information/businesses-and-employers/business-support-grants

The rate of payment for eligible businesses will be:

- For properties with a rateable value of £15,000 or under, grants will be £1,334 for the four weeks

- For properties with a rateable value of more than £15,000 and below £51,000, grants will be £2,000 for the four weeks

- For properties with a rateable value of £51,000 or over, grants will be £3,000 for the four weeks.

To make a claim, businesses will need their business rates number and to electronically upload the following documents:

- Proof of identification (e.g. financial accounts for a limited company or for passport or driving licence for a sole trader)

- Evidence of trading on 4 November 2020 (e.g. delivery note, expenses receipt, purchase order, sales receipt)

- Evidence of named holder of bank account (e.g. copy of bank statement)

- Evidence of occupation on 4 November 2020 x2 (e.g. utility bills including gas, electric, water or landline).

Applications for the Additional Restrictions Grant, which is given to businesses affected financially by the lockdown but which are not legally required to close, will open on Monday 23 November. Visit crawley.gov.uk/emergency/coronavirus-information/businesses-and-employers for more info.